charitable gift annuity canada

A charitable gift annuity may be funded with cash securities or a variety of other assets. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

If you make an irrevocable gift to Arthritis.

. At the end of life the remainder of your annuity capital becomes a gift for your favourite charities. Canadian Charitable Annuities Association CCAA The CCAA provides education information and guidance to charities registered under the Income Tax Act of Canada which receive. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor another person.

At the end of life the remainder of your annuity capital becomes a gift for your favourite charities. You can discuss this confidentially by. How does a Charitable Gift Annuity work.

A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. In essence Charitable Gift Annuities can be considered part investment and part charitable gift. Annuities are often complex retirement investment products.

In essence Charitable Gift Annuities can be considered part investment and part charitable gift. Learn some startling facts. Ad Support our mission while your HSUS charitable gift annuity earns you income.

Let us help you get started. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. The Canadian Revenue Agency CRA treats all or part of annuity income as a return of capital offering the donor access to greater monthly income than would otherwise be.

You can discuss this confidentially by. 11 Little-Know Tips You Must Know Before Buying. Ad Get this must-read guide if you are considering investing in annuities.

An annuity is simply a term that means a series of payments made at equal. Starting with a minimum gift of 10000 that can be funded with cash or other valuable property such as stocks a charitable gift annuity is established with the Canadian Medical Foundation. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. To qualify as a charitable gift annuity a minimum of 20 of the principal amount of the annuity must be a charitable gift. An annuity is simply a term that means a series of payments made at equal intervals.

Anne made a donation of 75000. A safe guaranteed income for. Additionally you will receive a charitable tax receipt for the gift portion of the payment.

Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return. Initial funding may be as little as 5000 though they tend to be much larger.

Ad Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Dont Buy An Annuity Until You Review Our Top Picks For 2022. Charitable Gift Annuities are giving vehicles that offer the same income security as GICs or other fixed income investments but with better cash flow.

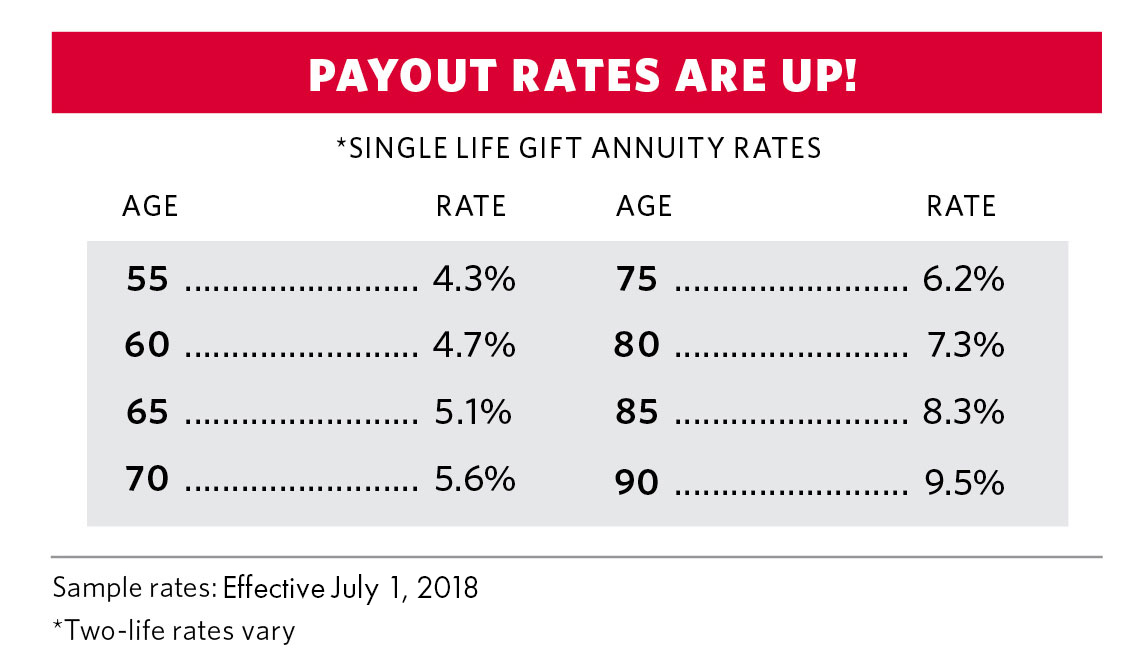

Payment rates depend on several factors. A charitable gift annuity to benefit the Catholic organization s of your choice is a generous expression of your support for the Catholic Church. Charitable Gift Annuities CGAs work the same way as regular commercial annuities but offer even more advantages because of a charitys tax.

Is a Humane Society gift annuity the right choice for you. Ad Support our mission while your HSUS charitable gift annuity earns you income. Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans.

The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of. Charitable Gift Annuity. One widely overlooked strategy deserves special attention from generous baby boomers and other individuals who want to reduce their taxes -- make a significant gift to a charity and.

The Catholic Gift Annuity program. Let us help you get started. Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo.

Give a thoughtful gift that gives back. Example of how a charitable gift annuity for an 80-year-old works. Is a Humane Society gift annuity the right choice for you.

Benefits of a Charitable Gift Annuity.

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

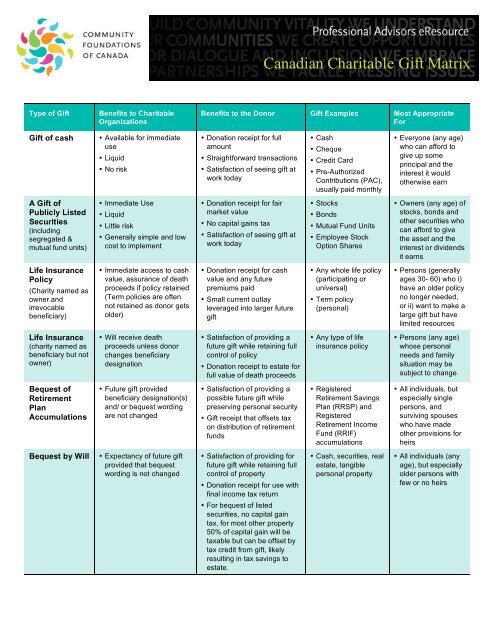

Canadian Charitable Gift Matrix Community Foundations Of Canada

Charitable Gift Annuities Studentreach

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Cga Archives Gordon Fischer Law Firm

Charitable Remainder Trusts Crts Wealthspire

Charitable Gift Annuities Citadel Foundation

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuity The Christian School Foundation

Tax Advantages For Donor Advised Funds Nptrust

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity